First, some definitions so that we all are on the same sheet of music. First of all the federal budget, like you would probably guess, is the total expected income and expenditures by the federal government for one year--pretty much like a family budget. The deficit is the amount that expenditures exceed the income in that year. Think of it as what we as a country charge on our credit card that year only. The debt is the sum total of all the deficits up to now, including the interest. Think of that as your total credit card balance.

OK, so our current national debt as I write this is just over 14 trillion dollars. How much is that?

Let's say you have a millionaire. Now let's get a LOT of millionaires. In fact, let's fill a major sports stadium (one that holds around 100,000 people) with millionaires. Once that stadium is filled with 100,000 millionaires, you are now up to 100 billion dollars. Ten of those stadiums would get you to one trillion dollars. It would take 140 stadiums filled with 100, 000 millionaires to get to 14 trillion dollars. So how many millionaires would that be? That's 14 million millionaires!

So... if we were to fix this by "taxing the rich", we would have to find 14 million millionaires and take everything they own to pay off the debt. I'm going to go out on a limb here and guess that's not going to happen, so I think we can see that this isn't the answer.

To pay off the debt, we have to run a budget surplus, meaning that we bring in more than we spend. As I mentioned in a previous blog post, Congress has been notoriously bad at this, but it's something we simply have to force them to do immediately. Why, you ask? Good question...

If we spent no more than we brought in, we'd NEVER pay off the debt--we'd just be marking time exactly where we are. So if we had a surplus on $1 billion dollars per year, how long would it take to pay off the debt? $14 Trillion divided by $1 billion is 14,000 years! If we managed to get a surplus of $100 billion a year, it would still take 140 years. (For perspective, the current House Republican plan only calls for $61 billion in spending cuts, and it's being hailed as too aggresive.)

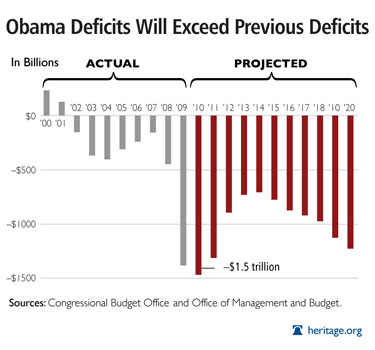

|

| Source: Heritage Foundation |

Now here's the bad news... we aren't anywhere near breaking even, even with those "aggressive" cuts. In 2009, the federal budget deficit was $1.4 TRILLION dollars. That means that just to break even (or "balance the budget"), we'd have to make $1.4 trillion in cuts just to start out. Then on top of that, we'd need to come up with still more money to pay down what we've already spent.

If we set a reasonable goal, say 50 years, to pay off the debt, we would need to cut current spending levels by $1.7 trillion dollars. Each and every year for the next 50, we would have to make sure we spent $480 billion less than we take in in order to get there.

One last bit of perspective. The current population as of the latest census was 308 million people. If you divide up the $14.362 trillion deficit evenly among each person in the country, the amount comes to about $46,000 for each and every person. Married couples--you owe $92,0000. Family of five--$234,000. That's YOUR SHARE of this debt--and it belongs to each and every one of us, whether we like it or not.

So... when you hear about "draconian" cuts to the federal budget, remember this--until our cuts exceed $1.4 trillion dollars, the ship is still sinking. And if we ever hope to save this ship, we need to do even better than that.