The argument of tax increases vs. spending cuts is a popular one in politics today, but it is the epitome of a red herring. To listen to the talking heads, either one is a valid option to solve the budget crises that plague both state and federal budgets. However, in this case, all things are not equal.

The debt crisis which has arisen did not occur due to a lack of funds. Federal and state revenues have steadily risen. The problem results from one very simple cause--no matter how much money governments bring in, they are spending more than that.

This is a very familiar scenario for most people who have gotten deeply into debt. It might start shortly after first becoming employed. You spend more than you make in anticipation of "making more next year." And you DO make more next year--but you also SPEND even more. But that's okay, because you'll make more next year. And so on. And so on. Despite a continually increasing salary, you find yourself deeper and deeper in debt. More income did NOT solve the debt crisis.

This problem can only be stopped (and later solved) in one way--by reducing spending below income. Once that has been achieved, then future income increases WILL actually lower your debt level IF you continue to live within your means.

For the last several decades, we as a nation have become addicted to debt, both in public and in private. No matter the tax revenue, spending has outpaced it. Regardless of how much money you hand to Congress, they have no problem spending it, and more. If we increased the tax rate to 100% and handed the entire GDP to Congress, under the current mindset they would spend 105% of it.

It is ESSENTIAL that we get spending under control. We can no longer afford as a nation to continue in this manner. Often when this comes up, someone will ask, "why is this a big deal NOW? The other party did it, too..." Unfortunately, that's correct--both parties have been guilty of this. As to why it has become more important now, well, two things are bringing this issue to a head.

First of all, returning to the example of a family running up credit card debt, our salary (the nation economy) is no longer steadily growing. The economy has become stagnant (or shrinking at times) with nothing on the horizon to improve it. We can't cover the bills any longer.

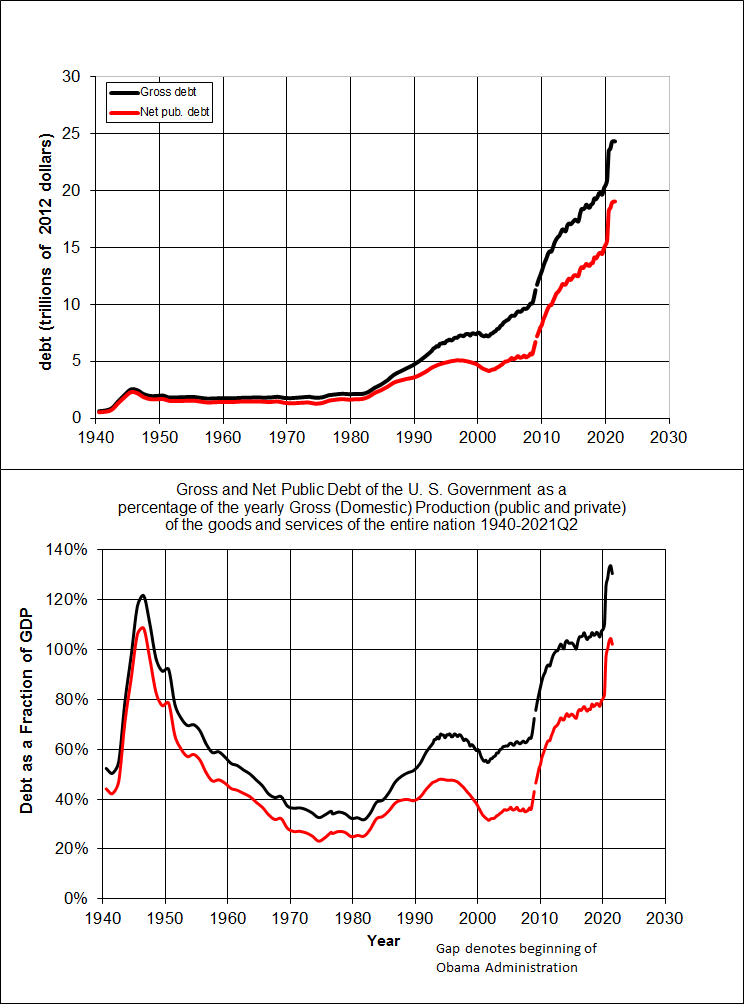

Second, as anyone who has ever sat through a presentation on investments is aware, compound interest eventually wins the day. When our debt was low and we paid large payments on it, the situation was not a crisis. But as the debt piled up (and so did the interest), the compounding interest began climbing the exponential curve toward oblivion. If you look at debt as a percentage of gross domestic product , you see how steeply the curve has risen over the last 3-4 years. Unless GDP begins growing again (immediately, rapidly and strongly) there is no way that we can get our debt situation under control.

(Image from http://en.wikipedia.org/wiki/United_States_public_debt )

Rather than try to solve the problem, Congress has tried to do even more of the same. For many years, our primary deficit (difference between revenue and spending, not including interest on the debt) wasn't so great. However, recently the primary deficit has increased. Add to that the fact that the total deficit (deficit including interest on the debt) has increased, and the situation becomes grave.

It is important that we as a nation become educated about our debt or it could soon devolve into a crisis unseen in this country's history (including the Great Depression). We must NOT hand more money to lawmakers, no matter how well intentioned--it would be like throwing gasoline onto a fire.

No comments:

Post a Comment

Feel free to make comments. We reserve the right to remove inappropriate posts. That doesn't mean we'll remove it if we disagree with it--merely that we don't allow obscene or insulting behavior in our "home."